How Taiwan became Arrakis

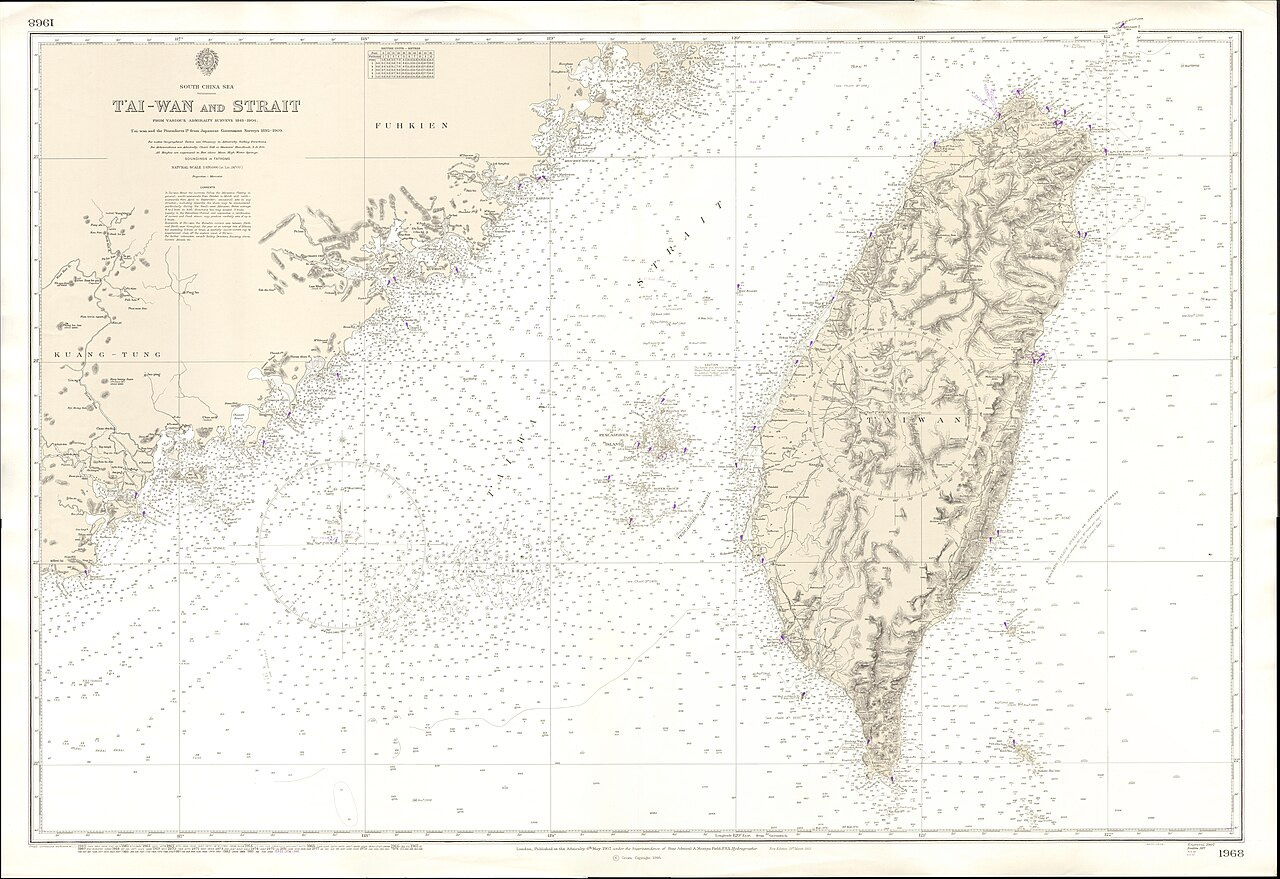

How did a poor island with a powerful enemy become Arrakis, an indispensable place in the global economy?

I saw this meme last year and then completely forgot about it, but after watching the new Dune, it popped back into my memory. Spice in Dune is like oil, a natural resource. But in Taiwan, there are no shai-huluds producing 3 nm chips, so how did it become Arrakis? Looking into its history, Taiwan is not so different from its neighboring countries—it wasn't an independent country with a powerful industrial complex like Japan, it had very few (if any) good universities, it had worse ties to the West than Singapore, South Korea, or Hong Kong, and it has a powerful rival/enemy just ~100 km away from it. So how did Taiwan become so important, how did it create one of the most complex industries known if all the inventions were done elsewhere, and it seems to be lacking any prerequisites for it? A similar question is about ASML—how the heck is it the only company making these wonder machines?

This essay draws heavily from Chris Miller’s Chip War; most quotes are from the book, if not indicated differently.

Chapter 1: Post-World War II Taiwan and Economic Foundations

Let's start with basic statistics about the island.1

Taiwan is roughly similar in population and area to the Netherlands, or in population to New York City and in area to the state of Maryland. Its population today is ~24 million, but in 1940, before the world war, when it was a Japanese colony, the population was less than 6 million.

Japan acquired Taiwan in 1895 after China lost the war. Japanese rule was harsh, and between 1895 and 1902, around 34,000 people were killed or died in anti-Japanese resistance (the island's population was about 3 million in 1905); additionally, 200 to 300 thousand people fled the island in 1895 alone. Although Taiwanese people were not happy with Japanese rule, the island was developed significantly: as Japan's first colony, Taiwan became its 'model colony.' Efforts were made to improve the economy and industry to support the Japanese military presence in the region. Japan created a centralized bank, updated the education system to its standards, and built railways, irrigation facilities, and power plants.

The objective was for Taiwan to provide Japan with food and raw materials. Fertilizer and production facilities were imported from Japan. Industrial farming, electric power, chemical industries, aluminum, steel, machinery, and shipbuilding facilities were set up. Textile and paper industries were developed near the end of Japanese rule for self-sufficiency. By the 1920s modern infrastructure and amenities had become widespread, although they remained under strict government control, and Japan was managing Taiwan as a model colony. All modern and large enterprises were owned by the Japanese.2

In 1945, when Japan surrendered, Taiwan returned to China, which was governed by the Kuomintang. The new government confiscated some previously Japanese-owned factories, but held the same monopolies as Japan before. The new government was seen as corrupt and incompetent, and in February 1947 locals protested and were brutally suppressed, around 18 to 28 thousand people were killed. When Kuomintang lost to the Communists in mainland China, Chiang Kai-Shek evacuated the government to Taiwan. More than 2 million people, soldiers and elites, moved there as well. After that, a Martial Law was imposed, and a period called White Terror began and lasted for almost 40 years, from 1949 to 1987. Local opposition was suppressed, around 140 000 people were imprisoned, and 3 to 4 thousands were executed by the government. Kuomintang claimed the whole Chinese territory as their territory, but lost Hainan in 1950, the Dachen Islands and Yijiangshan Islands during the First Taiwan Strait Crisis in 1955; Taiwanese islands were shelled by Mao's artillery in 1954 and 1958.

Following the eruption of the Korean War, US President Harry S. Truman dispatched the United States Seventh Fleet into the Taiwan Strait to prevent hostilities between the ROC and the PRC.The United States also passed the Sino-American Mutual Defense Treaty and the Formosa Resolution of 1955, granting substantial foreign aid to the KMT regime between 1951 and 1965. The US foreign aid stabilized prices in Taiwan by 1952. The KMT government instituted many laws and land reforms that it had never effectively enacted on mainland China. Economic development was encouraged by American aid and programs such as the Joint Commission on Rural Reconstruction, which turned the agricultural sector into the basis for later growth. Under the combined stimulus of the land reform and the agricultural development programs, agricultural production increased at an average annual rate of 4 percent from 1952 to 1959. The government also implemented a policy of import substitution industrialization, attempting to produce imported goods domestically. The policy promoted the development of textile, food, and other labor-intensive industries.3

In the 1950s and '60s, nobody would have expected Taiwan to become one of the most important places for the world economy - it was effectively a dictatorship with no human rights and no political opposition, with an unstable economy heavily aided by the US, and with a powerful enemy just a hundred kilometers away.

Chapter 2. American inventions

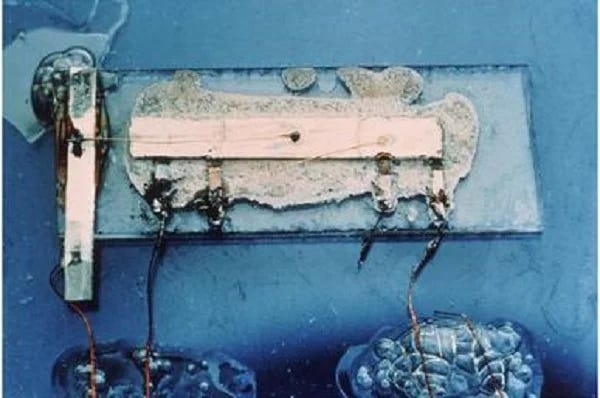

William Shockley, an obnoxious genius, invented the transistor in 1945 at Bell Labs. In 1947, his colleagues from Bell Labs, Walter Brattain and John Bardeen, created the first transistor based on Shockley's theory. Shockley was angered that they beat him in his work, and in 1948 invented a switch made from three chunks of semiconductors. All three received a Nobel Prize in Physics in 1956. However, Schokley wanted to be not only a scientist, but also a millionaire and a businessman, and so he launched a startup, Shockley Semiconductor, in 1955. An undeniable genius, he had absolutely zero managerial and leadership qualities, and soon eight bright employees left the company. They became known as the "traitorous eight"; they founded Fairchild Semiconductor, the first successful semiconductor startup. Their first product was Micrologic, a chip with four transistors in it.

Jack Kilby of Texas Instruments was one of the first people to work with transistors outside of Bell Labs. In 1958, he invented an integrated circuit - he placed multiple transistors into a single silicon unit. This was the first chip ever created. Bob Noyce, who had left Shockley Semiconductor a year earlier, invented the same thing, but without any freestanding wires; instead, he deposited lines of metal on top of insulation, creating a 'wire' between transistors on a chip. At that time, integrated circuits were very expensive to manufacture and had no market.

The first success came from the Space Race - NASA needed a computer for the Apollo lunar module, and Fairchild provided chips for it.4

By November 1962, Charles Stark Draper, the famed engineer who ran the MIT lab, had decided to bet on Fairchild chips for the Apollo program, calculating that a computer using Noyce’s integrated circuits would be one-third smaller and lighter than a computer based on discrete transistors. It would use less electricity, too. The computer that eventually took Apollo 11 to the moon weighed seventy pounds and took up about one cubic foot of space, a thousand times less than the University of Pennsylvania’s ENIAC computer that had calculated artillery trajectories during World War II.

MIT considered the Apollo guidance computer one of its proudest accomplishments, but Bob Noyce knew that it was his chips that made the Apollo computer tick. By 1964, Noyce bragged, the integrated circuits in Apollo computers had run for 19 million hours with only two failures, one of which was caused by physical damage when a computer was being moved. Chip sales to the Apollo program transformed Fairchild from a small startup into a firm with one thousand employees. Sales ballooned from $500,000 in 1958 to $21 million two years later.

As Noyce ramped up production for NASA, he slashed prices for other customers. An integrated circuit that sold for $120 in December 1961 was discounted to $15 by next October. NASA’s trust in integrated circuits to guide astronauts to the moon was an important stamp of approval. Fairchild’s Micrologic chips were no longer an untested technology; they were used in the most unforgiving and rugged environment: outer space.5

Another important player was the US Army, which wanted to make their bombs and rockets more precise. Photolithography was invented in a US Army Lab by Jay Lathrop, who tried to pack more transistors on a chip. He was awarded a modest sum for his invention, bought himself a wagon, and was almost completely forgotten by everyone, even though his invention was soon used by multiple companies and became an extremely important part of the business. Another army innovation was led by Texas Instruments, which created the first guided bomb first used in the Vietnam War.

Intel, founded by people who first left Shockley and then Fairchild, was the first company to produce semiconductor memory. They also invented the microprocessor in 1971, and set the PC standard for many decades when they partnered with Microsoft.

Gordon Moore, one of the original eight and later president of Intel, predicted 'Moore's Law': the number of transistors on a chip would double every few years. So far, everything has been going according to the Law.

Chapter 2.5. American companies and Asia

Fairchild was the first semiconductor manufacturer to open a facility in Asia. “In 1963, its first year of operation, the Hong Kong facility assembled 120 million devices. Production quality was excellent, because low labor costs meant Fairchild could hire trained engineers to run assembly lines, which would have been prohibitively expensive in California.” Soon, other companies followed suit. In the mid-'60s in Hong Kong, workers earned 25 cents per hour, “Taiwanese workers made 19 cents an hour, Malaysians 15 cents, Singaporeans 11 cents, and South Koreans only a dime.” In 1968, the first factory was built by Texas Instruments in Taiwan. The Taiwanese minister, K. T. Li, recognized the benefits of being an American ally, understanding that Taiwan urgently needed allies. Communist China successfully tested nuclear weapons in 1964, and thermonuclear weapons after that. K. T. Li himself was well-educated and had industrial experience; he studied nuclear physics at Cambridge and ran a steel mill. He correctly predicted that the more American assets and factories there are in Taiwan, the more willing America would be to provide safety guarantees to the island.

Singapore wanted to do the same, and in 1973 Lee Kuan Yew supported TI and National Semiconductors to build assembly facilities; in 1980s, this industry grew to 7% of Singapore’s GNP and employed thousands of workers.

Until the 1980s, almost all semiconductor inventions, and the lion's share of the market, were concentrated in the US. NASA, the US Army, Navy, and Air Force provided contracts, grants, and ran laboratories that pushed research forward. Early startups created the market and competed among themselves, with no foreign power to rival them. But what about other countries? It was the middle of the Cold War, so did the USSR build its own semiconductors in order to be ahead or at least on par with the States?

Chapter 3. USSR and China

The short answer is: yes, but... As usual for the USSR, it began developing the new field by spying and stealing. The funny thing is that the first semiconductors in the USSR were brought there by two American-born spies, Joel Barr and Alfred Sarant, who fled the country after the execution of atomic spies, Julius and Ethel Rosenberg, in 1953. The Soviets had some good universities and laboratories; they were able to build the atomic bomb, launch the first satellite, and send the first man into space, but they had a very strict hierarchy and a huge problem with the market—it didn't exist. When American companies competed for better products, they invented processes that made chips cheaper and better. They continuously upgraded their facilities to manufacture better chips, faster, and at as low a cost as possible. They were also able to hire the best people from the best universities and competed for them. These top talents were also able to start their own companies, etc. However, the USSR was different. Everything was done according to a plan, and if your lab was tasked with developing something, you couldn't argue. What's worse, many such developments were top-secret, and nobody—not even other researchers!—knew about them. As a result, few students are interested in studying your field if they know nothing about it. Without competition and a market, creating efficient methods to fabricate semiconductors is impossible.

What's even worse for the USSR, the people in charge of these decisions were not physicists or engineers but politicians and the KGB. American spies managed to convince Khrushchev to create a center for microelectronics in Zelenograd, the Communist Silicon Valley. The minister in charge didn't seek new research; instead, he wanted to copy existing American chips, centering the entire semiconductor industry in the USSR on recreating these chips. Without mass-scale production, yields were poor, and the USSR consistently lagged 3-5 years behind. In the KGB, a special department was established to steal the chips and equipment necessary for their manufacture.

It was hard enough to design chips in normal times. Doing so while battling the KGB was impossible. A second issue was overreliance on military customers. The U.S., Europe, and Japan had booming consumer markets that drove chip demand. Civilian semiconductor markets helped fund the specialization of the semiconductor supply chain, creating companies with expertise in everything from ultra-pure silicon wafers to the advanced optics in lithography equipment. The Soviet Union barely had a consumer market, so it produced only a fraction of the chips built in the West. One Soviet source estimated that Japan alone spent eight times as much on capital investment in microelectronics as the USSR.

Because of this approach, which Miller called 'copy it,' the USSR was always approximately five years behind. This gap widened after the dissolution of the USSR; Russia can't produce any cutting-edge chips, and before the war, even their Elbrus CPUs (outdated by modern standards) were manufactured in Taiwan. It's totally fine to buy chips if you are a normal country with normal companies. However, if you aim to compete for global dominance, depending heavily on your rivals for everything is an extremely stupid strategy. China seems to understand this now, although the start of its semiconductor research was even worse than in the USSR.

In the mid-1950s, China realized that semiconductors are important. In 1960, an institute in Beijing was created, with some scientists there who had Western education. In 1965, Chinese engineers created their first integrated circuit. The next year, Mao decided to target intellectuals and started the Cultural Revolution. The new semiconductor industry was doomed.

During the decade in which China had descended into revolutionary chaos, Intel had invented microprocessors, while Japan had grabbed a large share of the global DRAM market. China accomplished nothing beyond harassing its smartest citizens. By the mid-1970s, therefore, its chip industry was in a disastrous state. “Out of every 1,000 semiconductors we produce, only one is up to standard,” one party leader complained in 1975. “So much is being wasted.”

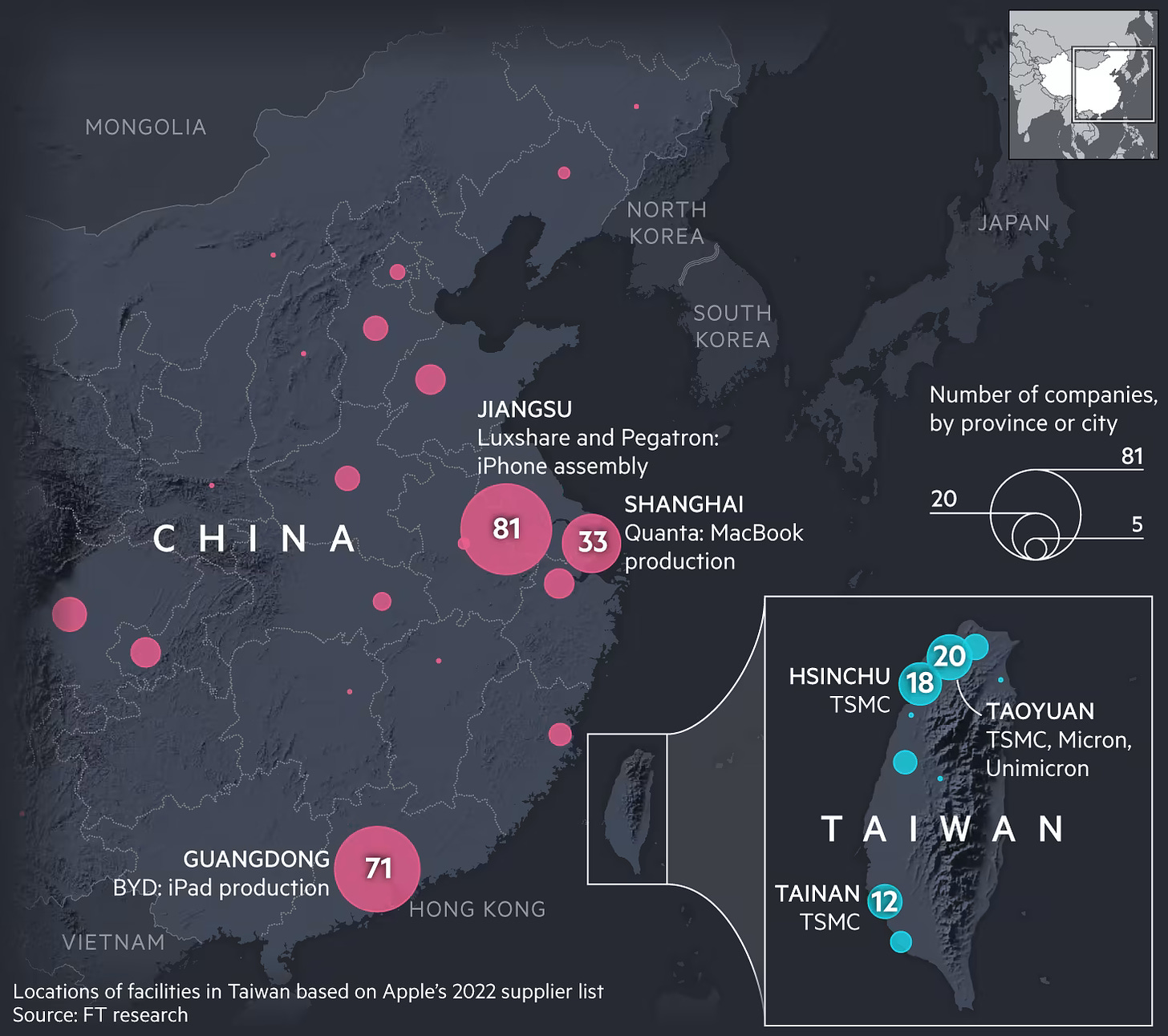

Though there are many assembly factories in China now, almost no company there can produce cutting-edge chips. Huawei relied on TSMC before it was banned by the US government; several attempts to build new companies were unsuccessful, even with billions of dollars spent by the government. US sanctions work well, and no Chinese company can buy ASML’s EUV photolithography machines, though they can purchase the previous generation and are able to produce some chips.

Chapter 4. Japan and South Korea

Both Japan and South Korea were pretty poor after the war. Their main advantages were low wages, an educated hard working population, and their relationship with the States.

"Made in Japan" was for the 1950s the same as "Made in China" for the 1990s - something cheap and not of good quality. Akio Morita, co-founder of Sony, wanted to change that. In 1953, he licensed the transistor with AT&T. The Japanese government supported development of the high-tech industry.

By 1964, Japan had overtaken the U.S. in production of discrete transistors, while American firms produced the most advanced chips. U.S. firms built the best computers, while electronics manufacturers like Sony and Sharp produced consumer goods that drove semiconductor consumption. Japan’s exports of electronics—a mix of semiconductors and products that relied on them—boomed from $600 million in 1965 to $60 billion around two decades later.

Japanese companies were known for their high quality, and were ruthlessly competitive. "Some Japanese played up the idea that they excelled at implementation, whereas America was better at innovation. “We have no Dr. Noyces or Dr. Shockleys,” one Japanese journalist wrote, though the country had begun to accumulate its share of Nobel Prize winners."6

The U.S. had supported Japan’s postwar transformation into a transistor salesman. U.S. occupation authorities transferred knowledge about the invention of the transistor to Japanese physicists, while policymakers in Washington ensured Japanese firms like Sony could easily sell into U.S. markets. The aim of turning Japan into a country of democratic capitalists had worked. Now some Americans were asking whether it had worked too well. The strategy of empowering Japanese businesses seemed to be undermining America’s economic and technological edge.

Japan was also very protective of its domestic market - while Sony and others could easily sell their products in the US, American companies struggled to have any sales in Japan. The government subsidized its firms, and with cheap credits, many new factories were built in the '80s. Even unprofitable companies survived, in stark contrast to American firms.

In the early 1980s, Japanese firms invested 60 percent more than their U.S. rivals in production equipment, even though everyone in the industry faced the same cutthroat competition, with hardly anyone making much profit. Japanese chipmakers kept investing and producing, grabbing more and more market share. Because of this, five years after the 64K DRAM chip was introduced, Intel—the company that had pioneered DRAM chips a decade earlier—was left with only 1.7 percent of the global DRAM market, while Japanese competitors’ market share soared.

But in 1986, Japan had overtaken America in the number of chips produced. By the end of the 1980s, Japan was supplying 70 percent of the world’s lithography equipment. America’s share—in an industry invented by Jay Lathrop in a U.S. military lab—had fallen to 21 percent.

Japanese factories were so efficient that even Intel started to copy their approach.

While the access to cheap money seemed good at that time, in the 1990s the Japanese stock market crashed, and many Japanese firms lost their advantage and subsequently the race.

Japan’s seeming dominance had been built on an unsustainable foundation of government-backed overinvestment. Cheap capital had underwritten the construction of new semiconductor fabs, but also encouraged chipmakers to think less about profit and more about output. Japan’s biggest semiconductor firms doubled down on DRAM production even as lower cost producers like Micron and South Korea’s Samsung undercut Japanese rivals

Japan’s largest mistake was that no one there was prepared for the rise of PCs and the microprocessors, pioneered by Intel. Most Japanese firms produced memory chips, specifically DRAM, and were unwilling to experiment with something new when they dominated the market. Although Intel was the first company to produce DRAM, it soon lost the market to Japan. In order to survive, Intel moved to a new market that hadn’t existed before: microprocessors.

South Korean Samsung began producing chips after Japanese firms did. Samsung had two advantages: support from the government, which offered loans and cheap credits from banks to companies developing high-tech, and American firms eager to outcompete the Japanese. In the 1980s, Samsung’s DRAM chips were sold under Intel’s brand; Micron also shared their technologies with them. The collaboration between Samsung, Korea's government, and top American companies was so successful that Samsung became one of the top chipmakers in the world, with only Intel and Taiwan's TSMC as its main competitors.

Chapter 5. Morris Chang and TSMC

Starting in the 1970s, the Taiwanese government tried to update their economy. In 1973, the Industrial Technology Research Institute was founded; in 1980, Hsinchu Science Park was opened. Taiwan already had some assembly factories, but no Taiwanese company competed in the global market. In 1980, the United Microelectronics Corporation (UMC) was created in Hsinchu. It was moderately successful but couldn’t compete with the leaders.

Morris Chang, a Chinese-born American engineer who opened the first TI factory in Taiwan, was chosen as Lisan al-Gaib of Taiwan.7 In 1985, the government decided to invest even more into semiconductors, and invited Chang to lead the effort. In 1987, he founded TSMC, Taiwanese Semiconductors, and hired multiple experienced people from the States.

Chang later summarized what were the initial conditions in Taiwan, and what he decided to do:

I paused to try to examine what we have got in Taiwan. And my conclusion was that [we had] very little. We had no strength in research and development, or very little anyway. We had no strength in circuit design, IC product design. We had little strength in sales and marketing, and we had almost no strength in intellectual property. The only possible strength that Taiwan had, and even that was a potential one, not an obvious one, was semiconductor manufacturing, wafer manufacturing. And so what kind of company would you create to fit that strength and avoid all the other weaknesses? The answer was pure-play foundry…

In choosing the pure-play foundry mode, I managed to exploit, perhaps, the only strength that Taiwan had, and managed to avoid a lot of the other weaknesses. Now, however, there was one problem with the pure-play foundry model and it could be a fatal problem which was, “Where’s the market?”

When I was at TI and General Instrument, I saw a lot of IC [Integrated Circuit] designers wanting to leave and set up their own business, but the only thing, or the biggest thing that stopped them from leaving those companies was that they couldn’t raise enough money to form their own company. Because at that time, it was thought that every company needed manufacturing, needed wafer manufacturing, and that was the most capital intensive part of a semiconductor company, of an IC company. And I saw all those people wanting to leave, but being stopped by the lack of ability to raise a lot of money to build a wafer fab. So I thought that maybe TSMC, a pure-play foundry, could remedy that. And as a result of us being able to remedy that then those designers would successfully form their own companies, and they will become our customers, and they will constitute a stable and growing market for us.8

The idea was revolutionary: make chips for anyone and don’t compete with your customers. It also helped to create a new type of startups, focused on chip design, with Nvidia being the best-known one.

TSMC was created with funding from the Taiwanese government (48% of investments) and with investments from Philips, who contributed $58 million, licensed their technologies to TSMC, and received 27.5% of the newly founded company. This also established a link between TSMC and ASML, the photolithographic equipment manufacturer founded by Philips. Both Intel and Texas Instruments were not interested in Chang's new company.

Chang was very competitive; he knew that in order to compete with the leaders, TSMC had to spend a lot of money on research, even if investors disagreed.9 And it worked. In the 2020s, TSMC accounts for more than a quarter of the Taiwanese stock market capitalization.10

In 2021, the Taiwanese president famously said “Our semiconductor industry is especially significant: a ‘silicon shield’ that allows Taiwan to protect itself and others from aggressive attempts by authoritarian regimes to disrupt global supply chains.” Not everyone agrees with that, but now everyone knows that Taiwan is important: in 2020, TSMC produced 22% of all chips in the world. What’s even more important is the kind of chips they produce. TSMC is the only manufacturer of Apple’s iPhone and Mac chips, Nvidia’s GPUs, Tesla’s specialised chips and Google’s TPUs; they produce a good share of 5G chips. AMD, Qualcomm, Amazon - all these companies depend on TSMC now.11 And all these chips require EUV - extreme ulraviolet lithography - machines, which can be produced only by ASML.

Chapter 6. ASML and a miracle of EUV

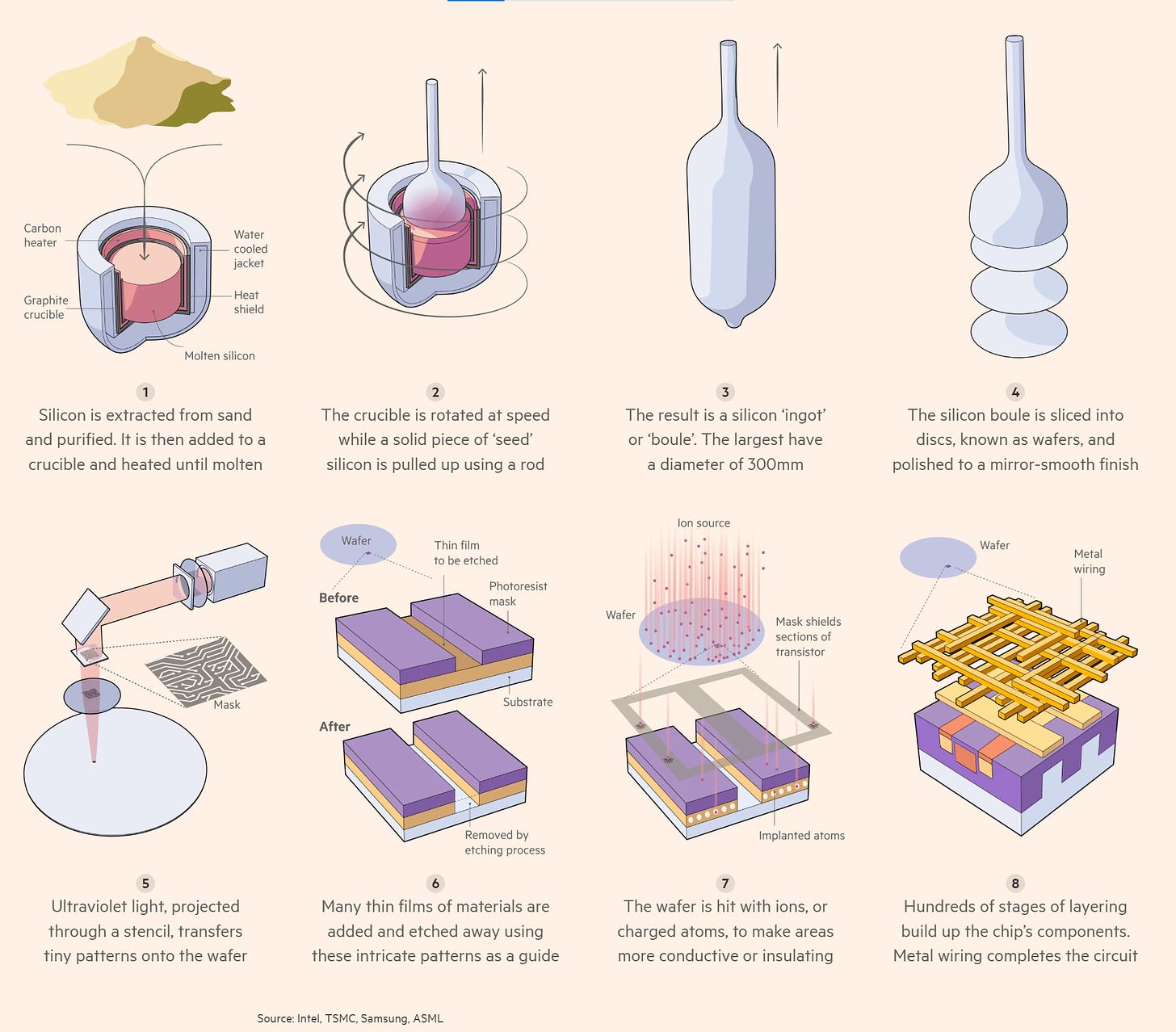

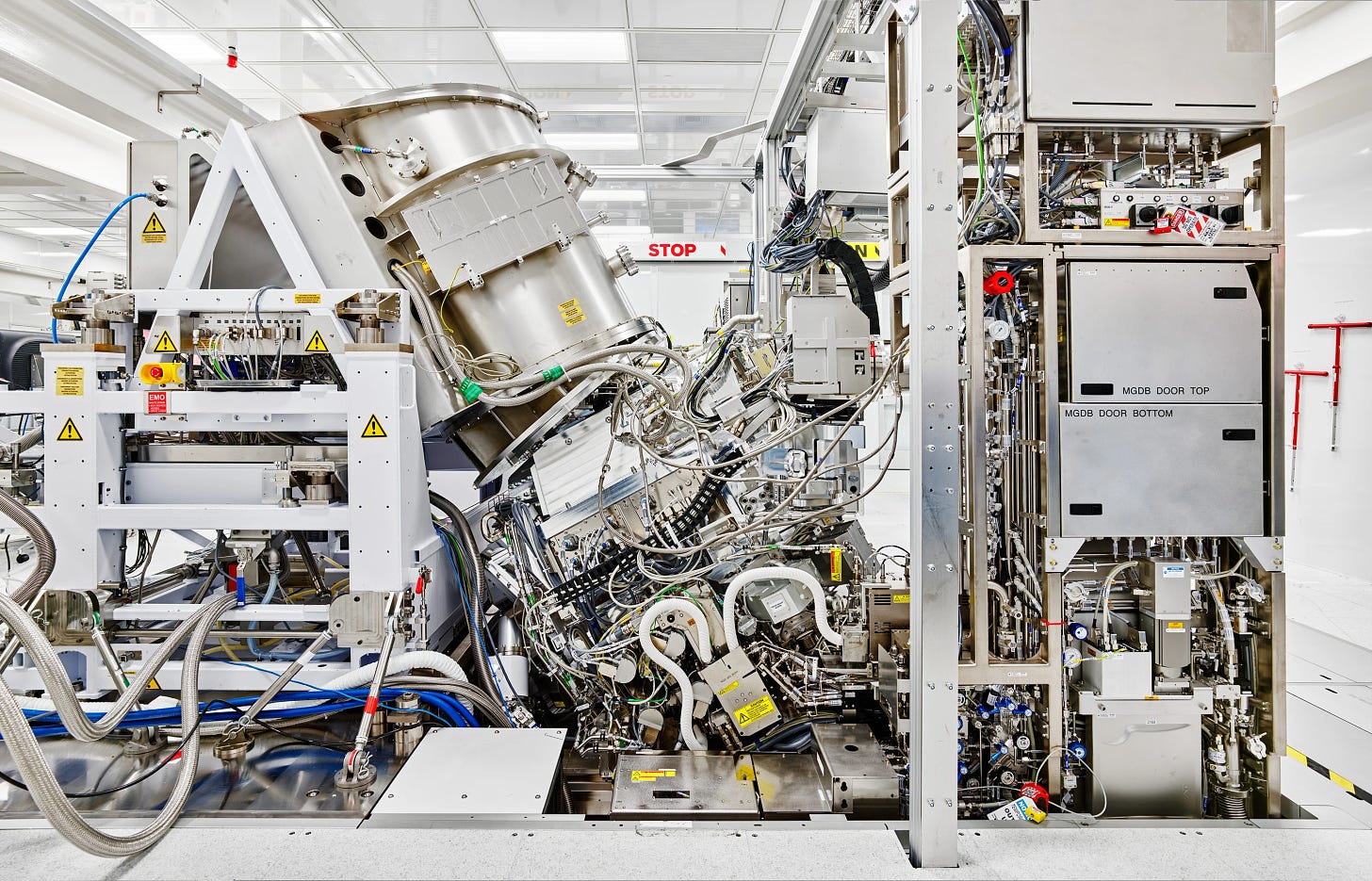

I haven't mentioned Europe, mainly because no European company produces cutting-edge chips today. However, this doesn’t mean there are no important European companies; on the contrary, the most important company in the entire industry is from the Netherlands, ASML. Founded by Philips in 1987, ASML is a manufacturer of photolithographic machines and has a 100% monopoly on extreme ultraviolet lithography (EUV) machines. The development of EUV was described as a marvel of engineering. The machine is called “The $150 Million Machine Keeping Moore’s Law Alive”, and was compared to the Manhattan Project and to “engineering a race car for an F1 driver”. I think it's more aptly comparable to the latest physics equipment, like the Large Hadron Collider with its detectors or the gravitational wave detectors, which require large collaborations, cutting-edge engineering, and billions of dollars to run the show.

An EUV machine costs 150 to 200 million $,12 and needs three or four Boeing 747 for transportation.13 The machines are so expensive that only five customers can afford them - Intel, Samsung, TSMC, Micron, and SK hynix. The first one was built in 2017 after 17 years of research and approximately 9 billion dollars in investment from Intel, Samsung, and TSMC (ASML’s largest customers). Few people, even from the industry, believed in its success. The machine is nightmarishly complex and require hundreds of suppliers (~800) and hundreds of thousands of parts. The fab that uses EUV is much more expensive - TSMC’s Fab 18 costs 17 billion dollars!

For simpler chips, ASML produces older deep ultraviolet (DUV) machines, and they are the majority of their sales.14 iPhone chips though can be produced only with EUV.

Here’s Brooking’s Institute description of EUV:

An extreme ultraviolet lithography machine is a technological marvel. A generator ejects 50,000 tiny droplets of molten tin per second. A high-powered laser blasts each droplet twice. The first shapes the tiny tin, so the second can vaporize it into plasma. The plasma emits extreme ultraviolet (EUV) radiation that is focused into a beam and bounced through a series of mirrors. The mirrors are so smooth that if expanded to the size of Germany they would not have a bump higher than a millimeter. Finally, the EUV beam hits a silicon wafer—itself a marvel of materials science—with a precision equivalent to shooting an arrow from Earth to hit an apple placed on the moon. This allows the EUV machine to draw transistors into the wafer with features measuring only five nanometers—approximately the length your fingernail grows in five seconds. This wafer with billions or trillions of transistors is eventually made into computer chips.

Miller provides some interesting details:

Building vast in-house manufacturing processes for lithography tools would have been impossible. Instead, the company decided to assemble systems from components meticulously sourced from suppliers around the world. Relying on other companies for key components brought obvious risks, but ASML learned to manage them. Whereas Japanese competitors tried to build everything in-house, ASML could buy the best components on the market. As it began to focus on developing EUV tools, its ability to integrate components from different sources became its greatest strength. […]

Consider, for example, what it would take to replicate one of ASML’s EUV machines, which have taken nearly three decades to develop and commercialize. EUV machines have multiple components that, on their own, constitute epically complex engineering challenges. Replicating just the laser in an EUV system requires perfectly identifying and assembling 457,329 parts. A single defect could cause debilitating delays or reliability problems. […]

The 13.5nm wavelength of EUV is closer to X-rays than to visible light, and as is the case with X-rays, many materials absorb EUV rather than reflect it. Zeiss began developing mirrors made of one hundred alternating layers of molybdenum and silicon, each layer a couple nanometers thick. Researchers in Lawrence Livermore National Lab had identified this as an optimal EUV mirror in a paper published in 1998, but building such a mirror with nanoscale precision proved almost impossible. Ultimately, Zeiss created mirrors that were the smoothest objects ever made, with impurities that were almost imperceptibly small.

Journalists even found the God-Emperor of Dune there; here’s Wired’s I Saw the Face of God in a Semiconductor Factory:

“We are doing atomic constructions,” Liu tells me. “I tell my engineers, ‘Think like an atomic-sized person.’” He also cites a passage from Proverbs, the one sometimes used to ennoble mining: “It’s the glory of God to conceal matter. But to search out the matter is the glory of men.”

THE TRANSUBSTANTIATION HAPPENING inside the fabs goes something like this. First comes the silicon wafer. A projector, its lens covered by a crystal plate inscribed with distinctive patterns, is craned over the wafer. Extreme ultraviolet light is then beamed through the plate and onto the wafer, printing a design on it before it’s bathed in chemicals to etch along the pattern. This happens again and again until dozens of latticed layers are printed on the silicon. Finally the chips are cut out of the wafer. Each chip, with billions of transistors stacked on it, amounts to an atomic multidimensional chessboard with billions of squares. The potential combinations of ons and offs can only be considered endless.

LATER, I’LL TAKE comfort in my TSMC-animated iPhone while I make a call home to my kids. Back in the US, I’ll remember that no global corporation deserves veneration. But while I’m in Taiwan, I see “no way out,” as Liu might put it, when it comes to the pursuit of Enlightenment ideals. There exists a physical world of calculable regularity. Math and logic can establish the truths of that world. Humans are capable of both profound goodness and feats of soaring genius. Democracy, individual liberty, and freedom of expression clear a path to wisdom, while closed autocratic hierarchies impede it.

When the first AI cult is created, TSMC fabs must be its shrines, centered around the EUV machines.

ASML already works on the next generation machines, called High NA, that will cost around 380 million each.15 Currently, only Intel has expressed interest and received the first test machine; TSMC has no immediate plans to use them.

Chapter 7. What’s now?

TSMC is indispensable to the global economy. All GPUs used for AI, iPhone CPUs, and 5G equipment, among others, are produced by TSMC. Everyone understands it now, and the US proposed the CHIPS Act - 280 billion dollars for manufacturers willing to build new fabs in the US - to lessen this dependency. TSMC is building a fab in Arizona right now, though there is a lot of friction. The work style is very, very different:

Having worked in Texas and California as well as in Taiwan, Chiang was always struck by the ambition and the work ethic that drove TSMC. The ambition stemmed from Morris Chang’s vision of world-beating technology, evident in his willingness to spend huge sums expanding TSMC’s R&D team from 120 people in 1997 to 7,000 in 2013. This hunger permeated the entire company. “People worked so much harder in Taiwan,” Chiang explained. Because manufacturing tools account for much of the cost of an advanced fab, keeping the equipment operating is crucial for profitability. In the U.S., Chiang said, if something broke at 1 a.m., the engineer would fix it the next morning. At TSMC, they’d fix it by 2 a.m. “They do not complain,” he explained, and “their spouse does not complain” either. With Chiang back in charge of R&D, TSMC charged forward toward EUV. He had no difficulty finding employees to work all night long.16

And

Beginning in 2021, hundreds of American engineers came to train at TSMC, in anticipation of having to run a TSMC subsidiary fab in Arizona that is slated to start production next year. ... American engineers have called TSMC a “sweatshop,” while TSMC engineers retort that Americans are “babies” who are mentally unequipped to run a state-of-the-art fab. Others have even proposed, absent evidence, that Americans will steal TSMC secrets and give them to Intel, which is also opening a vast run of new fabs in the US.17

The policies can also be a problem:18

Commentators have noted that CHIPS and Science Act money has been sluggish. What they haven’t noticed is that it’s because the CHIPS Act is so loaded with DEI pork that it can’t move. […]

That project is going better for Arizona than the actual chips part of the CHIPS Act. Because equity is so critical, the makers of humanity’s most complex technology must rely on local labor and apprentices from all those underrepresented groups, as TSMC discovered to its dismay.

Tired of delays at its first fab, the company flew in 500 employees from Taiwan. This angered local workers, since the implication was that they weren’t skilled enough. With CHIPS grants at risk, TSMC caved in December, agreeing to rely on those workers and invest more in training them. A month later, it postponed its second Arizona fab.

Perhaps only China, Apple, and TSMC’s other customers know how integral the fabs are, but their absolute devotion, their terror of rocking the boat, is more than enough to secure real-world power for the company. Several people at TSMC told me their work at arguably the most powerful company on the planet is “unsexy.” One told me that girls don’t fall for TSMC engineers, but their mothers do. Invisible as suitors. Indispensable as husbands.19

I've only touched the surface of what's coming in this long post. China is very ambitious, and their 'Made in China 2025' initiative is particularly interesting. The CHIPS Act could either be a great success or a great failure. Intel is keen to use High NA machines, and who knows, maybe TSMC is in trouble. But right now, TSMC and ASML are the most important companies in the world, and Taiwan has become Arrakis.

Can this be replicated? I don’t know; it seems to be extremely hard. You need cheap but well-educated labor, a clever government that’s not afraid to bet big money, an ambitious and experienced person to run the new business, a good relationship with the US, licensed or your own technologies, and a ton of luck. Or, who knows, maybe Morris Chang really is Lisan al-Gaib, who knows the ways of the silicon...

Here are few more links if you want to dig deeper:

This is my first post here, if you see any errors, please comment and let me know!

Please note that I’m not an expert in Taiwanese history, so treat this section as a condensed simplified history.

More about Apollo computer - Silicon Chips Take Man to the Moon, Smithsonian - Apollo Guidance Computer and the First Silicon Chips, and NASA's movie from the 1960s

Miller, Chip War. All quotes without a footnote are from this book.

This contrasts with the war years; nice quote I saw in Dan Wang’s excellent 2023 letter:

A gag I saw on Twitter: “every Pacific encounter from late 1943 onward is like the IJN Golden Kirin, Glorious Harbinger of Eternal Imperial Dawn, versus six identical copies of the USS We Built this Yesterday, supplied by a ship that does nothing but make birthday cakes for other ships.”

And of course I’m not the first one to think about this, here is from Wired’s article: “Krach now calls Chang “the oracle.””

I saw it in this Stratechery post, though originally it is from this Chang’s interview.

See also TSMC’s top-10/20/30/40 customers

Sources vary. CNBC talks about 200 m $, MIT Technology Review gives 180 m $, Wired gives 150 m $.

Again, Wired and CNBC talk about 3, while MIT Technology Review about 4.

For the early ASML history, check this post The Founding of ASML - Part 1: The Philips Era

More about High NA from Zeiss: More light for more details The next step for EUV lithography

Chip War